Overview

In the most recent Israeli aggression on the Gaza Strip, we saw reports that people were unable to donate for impacted families under attack using Venmo. Human rights organizations in Palestine reported that they were unable to access funds they raised on PayPal to support impacted communities. This all comes as a result of an ongoing and systematic exclusion of Palestinians from digital payment platforms that we have witnessed take place for years.

Since 2016, 7amleh — The Arab Center for the Advancement of Social Media and a number of civil society organizations have been advocating for PayPal to offer its services in Palestine. PayPal, a global digital payment company, operates in over 200 countries, including some countries which struggle with major political and economic instability such as Yemen, Egypt, and Somalia. PayPal offers its services in Israel, including in Israeli settlements in the occupied West Bank, but the company does not grant Palestinians with bank accounts in the West Bank and Gaza Strip access to its platform. PayPal claims that its services are unavailable to Palestinians on the basis of its “Prohibited Countries” policy, which classifies Palestine and around 30 other countries as “high-risk” areas.

PayPal does however provide full access to the estimated 9.2 million Israeli citizens, this includes Palestinian citizens of Israel, as well as Israeli settlers residing in Israeli settlements in the West Bank, which are unlawful under international law. PayPal services are also available to the nearly 340,000 Palestinian residents of occupied East Jerusalem.

PayPal’s Policy of Discrimination

In Palestine, PayPal’s services are provided under conditions of discrimination, as the company excludes over five million Palestinians in the rest of West Bank and Gaza Strip, from its services. Whereas PayPal’s services are available to Israeli settlers residing in settlements in the occupied West Bank, which are often built unlawfully on Palestinian land for the sole benefit of Israeli settlers and entrench discriminatory Israeli practices against Palestinians, their Palestinian counterparts living in the same territory are denied access to the platform.

As such, PayPal’s policy to deny Palestinians in the West Bank and Gaza appears to be based on the discriminatory grounds of national or ethnic origin rather than location. Differential treatment, on the basis of race, ethnicity, and national origin, violates the fundamental prohibition against discrimination under international human rights law. PayPal has a responsibility to respect human rights, in accordance with the United Nations Guiding Principles on Business and Human Rights (UNGP), and must ensure its services and operations are provided in a non-discriminatory manner on the basis of race, ethnicity, and national origin.

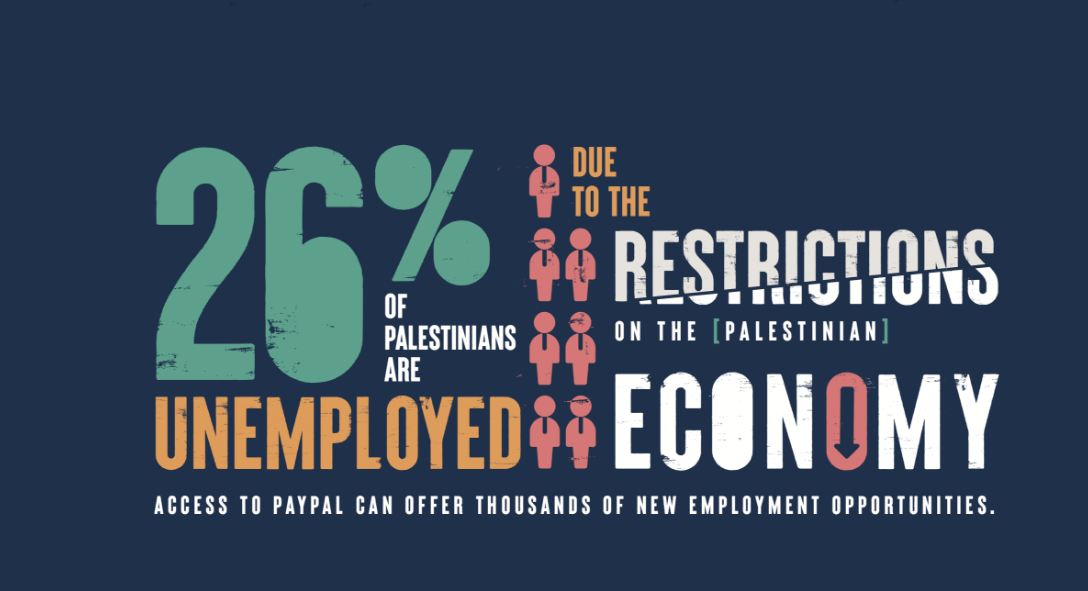

PayPal’s decision is also biased as it unequally provides Israeli freelancers, startups, entrepreneurs and businesses with far more opportunities than their Palestinian counterparts, who face high unemployment rates (28% as of March 2021, including 17% in the West Bank and 48% in Gaza)) and a codependent and weak economy, in large due to Israel’s discriminatory restrictions imposed on imports, exports, access to resources and movement in the West Bank and to an even larger extent in the Gaza Strip. By excluding Palestinians in the West Bank and Gaza Strip from its service and making it available to Israeli settlers, PayPal indirectly contributes to the inherently discriminatory Israeli occupation, and further exacerbates its devastating impacts on the Palestinian population and its economy.

Moreover, PayPal’s operations in illegal settlements in the oPt are in violation of their responsibility not to contribute to violations of human rights, as provided by the UNGP. Israeli settlements are part of Israel’s discriminatory regime that privileges Israeli settlers over Palestinians residing in the oPt. Businesses operating in Israeli settlements sustain the existence of such settlements, support their expansion, and benefit from Israel’s discriminatory practices against Palestinians in the oPt. Many human rights organizations have documented how businesses in Israeli settlements contribute to serious violations of international humanitarian and human rights law.